On 20th August 2021, Bank of Uganda (Hereinafter referred to as “BOU”) issued a circular notifying financial institutions of a proposal to increase the minimal capital requirements for supervised financial institutions including commercial banks, credit institutions and micro deposit taking institutions (hereinafter referred to as “SFI’s).

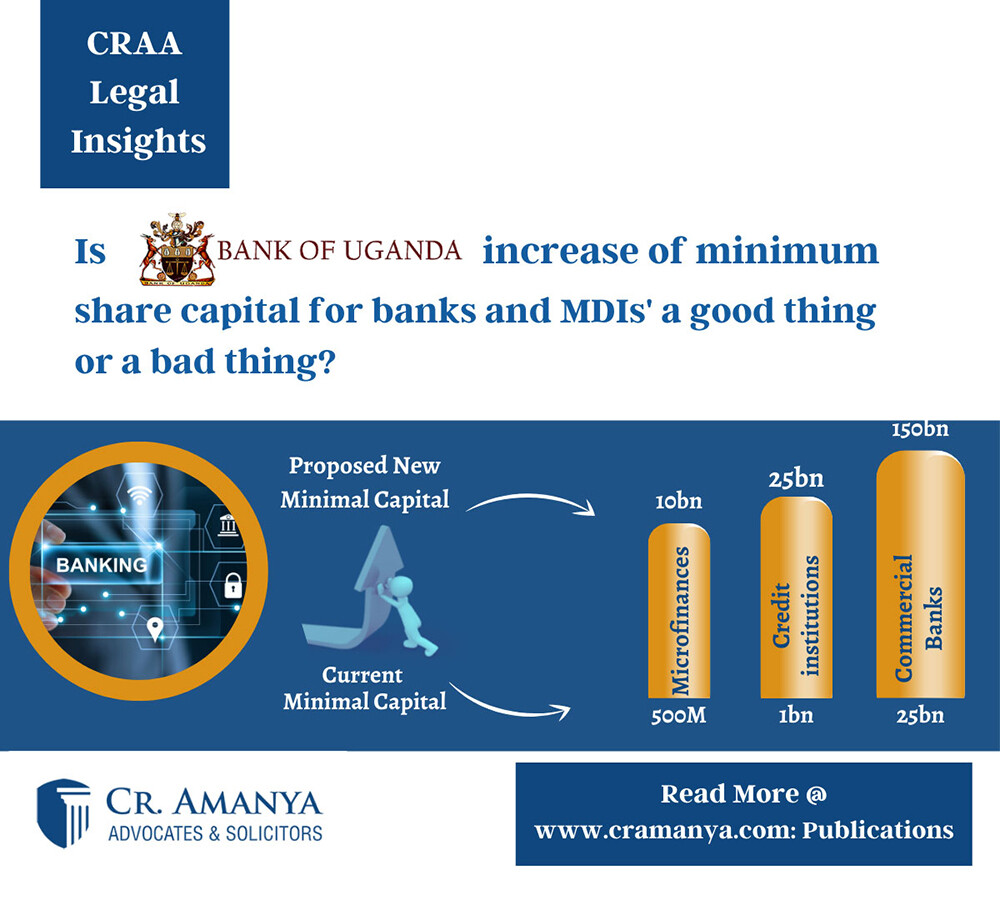

Currently the minimal paid up share capital requirements for SFI’S are as follows:

- Tier 1 Commercial Banks UGX 25bn, this was last reviewed in 2010,

- Tier II Credit Institutions UGX 1bn, this last revised in 2004, and

- Tier III Microfinance Deposit Taking Institutions (MDI’s) UGX 500m, last revised in 2003.

The new proposal for increment of minimum paid up share capital requirements is as follows:

- Tier I to be increased from UGX 25bn to UGX 150bn,

- Tier II to be increased from UGX 1bn to UGX 25bn, and

- Tier III to be increased from UGX 500M to UGX 10bn.

Based on the 2020 Audited financial statements of SFIs’ 10 out of the 25 Banks and Tier 1 players already met this new proposed requirement. While in Tier II, two out of five meet the proposed new requirement. In Tier III, three out of four meet the proposed new capital requirements.

The Proposed Increment is not intended to take immediate effect and will give the non-complaint entities a three-year grace period i.e. timeline in which to raise their minimum capital levels to meet the new thresholds.

The Rationale of this proposal

According to Bank of Uganda’s Executive Director, Dr. Tumubweinee Twinemanzi, the rationale of this proposal is that the real value of the current minimum capital requirement has been eroded over time and needs to be aligned with macroeconomic developments (GDP growth, inflation, and UGX/USD exchange depreciation over a number of years). Additional Bank of Uganda is proposing to align capital with financial system developments including changes in regulation, growth in assets and risk exposure. There is also need to enhance domestic capacity to finance Uganda’s growing economy. Furthermore, There is need to enhance Uganda’s banking industry competitiveness in the East African community. Uganda’s minimum capital requirements of Ugx 25bn equates to USD 6.8m whereas Kenya and Tanzania are at USD 10m with the former proposing to move to USD 50m. Rwanda is at USD 25M, South Sudan is at USD 30M and Zambia is at USD 20M (with USD 100M for foreign banks).

Therefore, whereas it is clear that the proposal will cause some discomfort to some of the banks’ shareholders especially those with share capital below the threshold, there are several benefits to both the financial services industry and the wide economy to be realized. These include:

- Higher capital enables banks to increase their lending capacity including the single borrower’s limit.

- Ugandan banks will start comparing favourably with their peers in the region and giving themselves a chance to compete.

- More Ugandan banks will have positioned themselves better to take advantage of opportunities in the oil and gas sector as most of the funding requirements necessitate large capital bases.

- A lot of the syndicated deals done offshore through regional and head office structures will now be done onshore as the local banks will now have the capital. This improves visibility to Uganda Revenue Authority and increased revenue collection.

- The regional banks that do not meet this threshold will be compelled to increase their investment in Uganda

- This can also be an opportunity for the growth of our capital markets as banks can take a leaf from their Kenyan counterparts to leverage domestic capital markets to address capital funding requirements. This would give Ugandans a massive opportunity in banks and MDI’s.

Notwithstanding the above possible benefits, we are likely to see more mergers, sales, and acquisitions of SFIs’ as was the case in Nigeria when Governor of Central Bank of Nigeria Mr. Lamido Sanusi raised minimum capital requirements in 2009. This was part of wider reforms introduced in the banking sector of Nigeria that resulted in fewer players with stronger capital and balance sheets with a muscle to move out into the region. We at CR. Amanya Advocates & Solicitors (CRAA) therefore welcome and support this proposal.